city of cincinnati tax return 2020

513-352-2546 513-352-2542 fax taxwebmastercincinnati-ohgov. 2020 Individual Tax Return FIRST NOTICE OR FISCAL PERIOD _____ TO _____ Amended Return Final Return City of Blue Ash Tax Office Phone.

12 Best Big Cities To Live On Just A Social Security Check Gobankingrates

Income Tax Office 805 Central Ave Suite 600 Cincinnati OH 45202.

. Click on the fields below and type in your information. The tax rate remains the same for the tax year 2020 and was also set prospectively at 0525 for the tax year 2021. The taxpayer filed an amended consolidated Cincinnati income tax return which included the taxpayer and its various subsidiaries.

Cincinnati tax forms are available on this website or at our offices located at 805 Central. If you are a resident of the city of Cincinnati you may not allocate days worked out of the city. Help us to use your tax dollars wisely by sending us this information with your tax form.

Refund requests must be made within three years from the date of your tax payment the date the tax. E-File provides an easy-to-use system that allows businesses to make withholding and estimated tax payments through ACH Debit. PO Box 637876 Cincinnati OH 45263-7876 Returns must be filed by everyone required to submit a Declaration of Estimated Tax even though the Declaration was accurate and paid in full.

Employers can also use this application to E-File their year-end withholding reconciliation and to. Get OH Individual Tax Return - Cincinnati 2020-2022. Rate City Of Cincinnati The Best Template And Form as 5 stars Rate City Of Cincinnati The Best Template And Form as 4 stars Rate City Of Cincinnati The Best.

4645 Montgomery Road Norwood Tax Office Norwood OH 45212. Visit the Tax Department page for forms documents and further information on municipal income taxes. Full-year residents should use the Individual Tax Return Mail Completed Forms to.

Tax rate for nonresidents who work in Cincinnati. Tax Return Instructions Use this form if you are an individual who receives wages reported on Form W-2 and you are claiming a refund. Then print the form and mail it to our officeCity of CincinnatiIndividual Tax Return 2020TO EXPEDITE PROCESSING PLEASE DO NOT STAPLE Account.

General forms used year-to-year for your City of Cincinnati income taxes. Line 5 Multiply the amount of Line 3 or Line 4 by 21. _____ 20 FOR OFFICIAL USE ONLY Q-2 Employer Quarterly Return of Withholding Tax 20.

CITY OF CINCINNATI 2020 BUSINESS INCOME TAX RETURN INSTRUCTIONS Office Phone. We offer E-File for the annual tax returns for individuals and the option of making a payment. At 21 the city of Cincinnati has the highest income tax in the region and tens of thousands of jobs held by people who do not live within its corporate limits.

Start putting your signature on tax return cincinnati form by means of solution and become. The Ohio First District Court of Appeals recently addressed whether a City of Cincinnati tax ordinance which set forth the requirements for filing consolidated City income tax returns was preempted by a state statute. Use the Individual.

CINCINNATI OH 45263 FOR OFFICIAL USE ONLY Q-1 Employer Quarterly Return of Withholding Tax 2020 Account. Skip to main content Press Enter. While every effort is made to assure the data is accurate and current it must be accepted and used by the recipient with the understanding that no warranties expressed or implied concerning the accuracy reliability or suitability of this data have been.

City of cincinnati tax return 2020 Friday March 18. April 30 2020 Amount Due. 2020 business income tax return filing required even if no tax due due on or before april 15 2021 or within 3½ months from end of fiscal year beginning _____ and ending _____ federal id no.

1 Beatles Vintage Unused Full Concert Ticket 1966 Cincinnati Ohio Laminated Lrb In 2020 Beatles Vintage. Therefore there is no refund opportunity when filing a tax return for 2020 if you were working at home due to Covid-19. Cincinnati Income Tax Return for the taxpayer account name and account number listed below.

Request for an extension of time to file your annual return must be submitted in writing prior to the due date of the tax return. To insure proper processing type or print each taxpayer s Cincinnati tax account number name and SSNFID in. CITY OF CINCINNATI INCOME TAX BUREAU 805 CENTRAL AVENUE SUITE 600 CINCINNATI OH 45202-5756.

Email the Tax Department. Part A - Tax Calculation. At the December 21 2020 Council meeting Village Council voted to pass its annual Income Tax Ordinance which maintained the tax rate of 0525 as provided in Section 93A-03 of the Code of Ordinances.

PO Box 637876 Cincinnati OH 45263-7876. Tax Return City of Cincinnati TO EXPEDITE PROCESSING PLEASE DO NOT STAPLE. Use this return if you were a nonresident or part-year resident of Cincinnati and you are filing for a refund of taxes withheld by your employer.

To the best of my knowledge and. The due date for filing your annual Cincinnati Income Tax Return is April 15th or the 15th day of the fourth month following the end of each taxable year. However section 6103 allows or requires the IRS to disclose or give the information shown on your tax return to others as described in the Code.

This prospective 2021 rate. March 31 2020 Due Date. Nonresidents who work in Cincinnati also pay a local income tax of 210 the same as the local income tax paid by residents.

Filing Requirements All Cincinnati residents regardless of your age or income level who receive taxable compensation are required to pay the City of Cincinnati income tax at the rate of 18 effective 100220 and 21 prior to 100220. City of cincinnati tax requirements. SW Washington DC 20585 202-586-5000.

The account information contained within this web site is generated from computerized records maintained by the City of Cincinnati. Employees whose only source of taxable income is from employers who withhold and remit their income taxes to Cincinnati are not required to submit a Declaration of Estimated Tax or file a return. Residents of Cincinnati pay a flat city income tax of 210 on earned income in addition to the Ohio income tax and the Federal income tax.

Use a cincinnati tax forms 2020 template to make your document workflow more streamlined.

I Made Phone Wallpapers Based On The Jerseys Of Every Nfl Team With Throwbacks As An Added Bonus Im Chiefs Wallpaper Kansas City Chiefs Football Nfl Teams

Gcww Emergency Rental Assistance Program Provides Gcww Utility Bill Assistance For City Of Cincinnati Tenants Gcww

2020 Where To Mail 941 Wisconsin West Virginia Rhode Island

Cincinnati City Council Candidates Talk Transportation Issues Wvxu

Cincinnati S Metro System Free Fare Week Boosts Ridership

Can Cincinnati Continue To Tax The Income Of Remote Workers

Free Image On Pixabay Buildings Bridge Illuminated New York City Vacation New York Vacation Solo Travel

Amberley Village Tax Resources Amberley Village

University Of Cincinnati College Of Law Llm Guide

The Gibbs Firm Property Tax Appeals Litigation

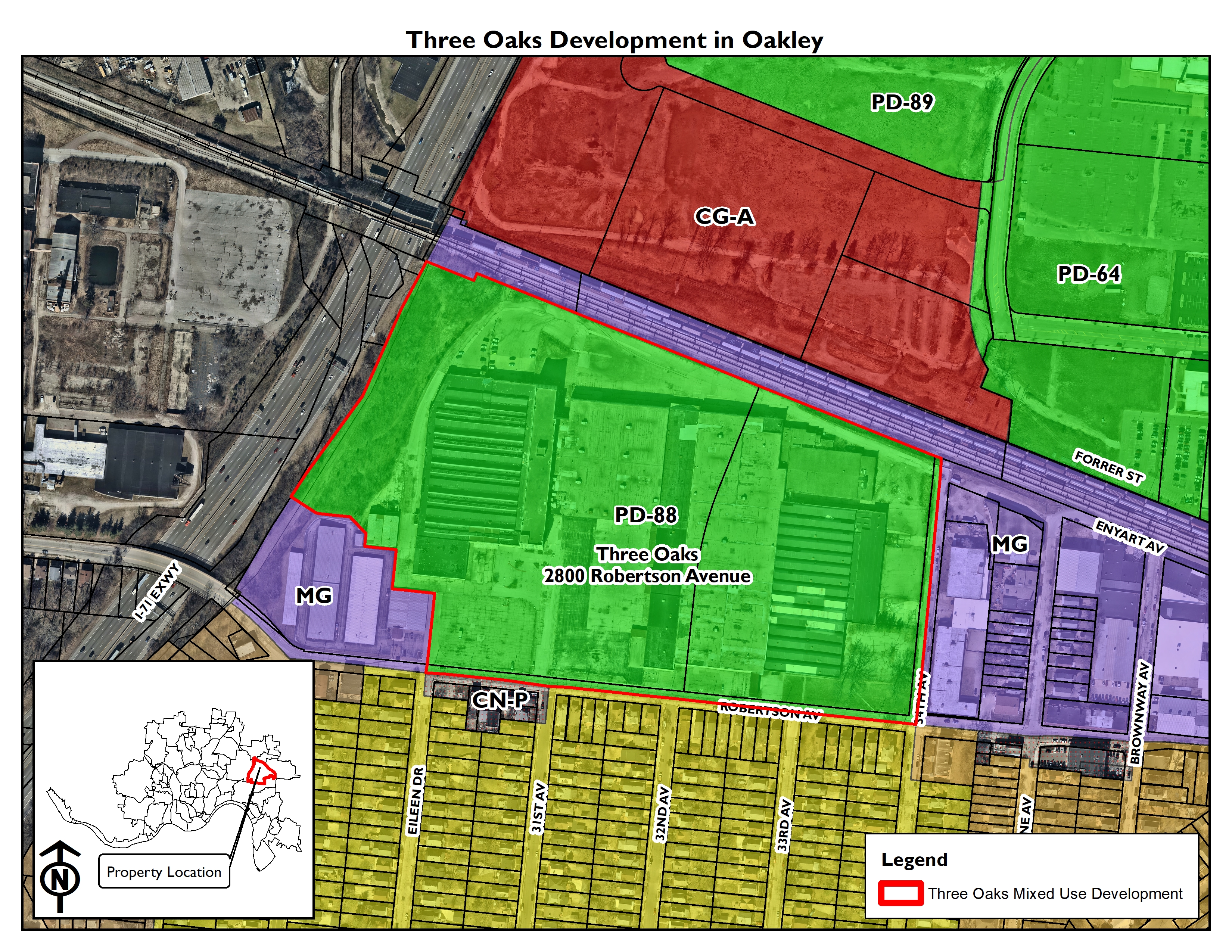

Three Oaks Development In Oakley City Planning

Emergency Rental Assistance Gcww

Search Browse Page 1 Of 16 Tyler Data Insights

Emergency Rental Assistance Gcww

Take A Walk Through The Changing Face Of Downtown

513 275 8397 Winning The Lottery Lottery National Insurance

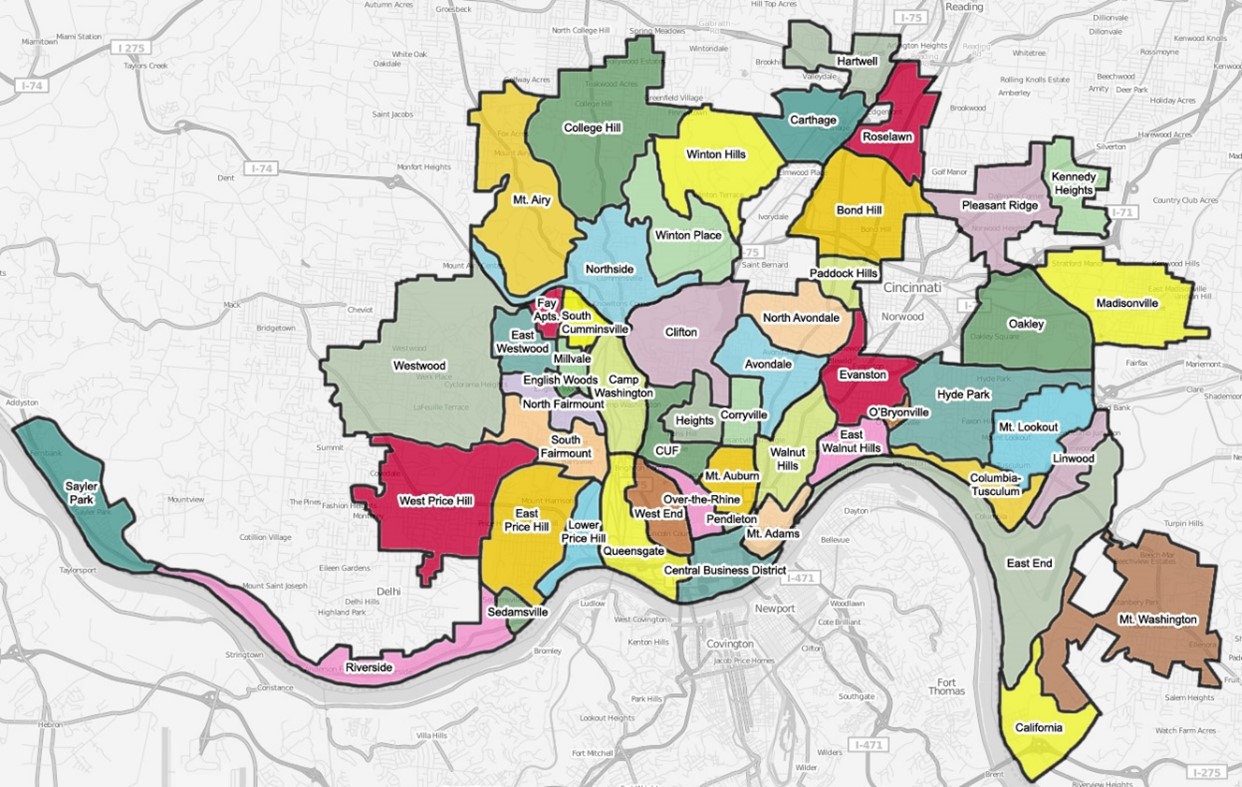

2020 Census In Greater Cincinnati Takeaways And Over The Rhine S Mysterious Population Decline Cincinnati Business Courier